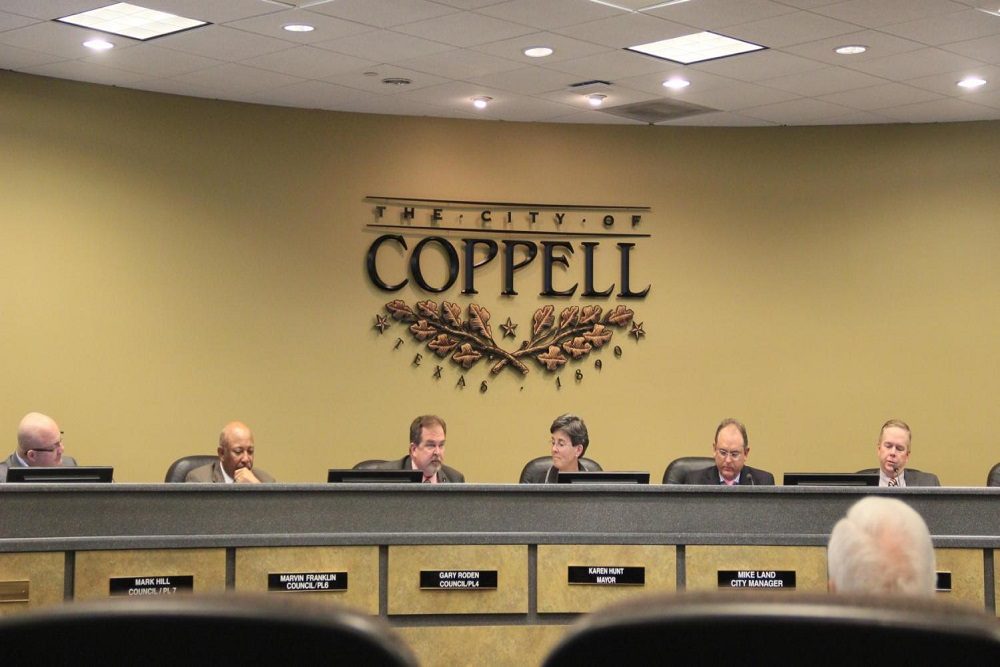

City of Coppell issued the following announcement on July 9

The Coppell City Council will hold a Budget Workshop to discuss the Water and Sewer Fund and Special Revenue Funds at 6 p.m. on Tuesday, July 20. The public is encouraged to get involved, attend, and provide feedback!

What are Special Revenue Funds?

Like many other governmental organizations, the City of Coppell uses a fund basis of accounting. Funds are normally established for each major type of revenue for specific functions. Each fund is a self-balancing set of accounts, used to determine the sources and uses of a specific type of revenue stream. City of Coppell funds include the General Fund, Debt Service Fund, Water and Sewer Fund, Internal Services Funds, and Special Revenue Funds.

Special Revenue Funds are used to account for revenues that are restricted for special and particular purposes. The Special Revenue Funds used by the City of Coppell include:

- Child Safety Fund: Restricted to use for Police Department programs that enhance child safety, health or nutrition, including, educational supplies and the red ribbon program. This is funded by a portion of each citation given for a violation in a school zone.

- Police Fund: Restricted to use for Police Department programs, such as SWAT, Coppell’s award-winning National Night Out, and the honor guard. This is funded by forfeitures, seizures, grants, and donations.

- Tree Preservation Fund: Used for tree preservation efforts, such as planting, trimming and the removal of fallen trees. Tree reparations paid by developers supply revenue to this fund.

- Infrastructure Maintenance Fund: Used for the maintenance of City infrastructure. This fund is used for projects such as sidewalk repairs, sign and signal maintenance, pavement improvements, ADA improvements, and major projects such as the reconstruction of Airline Drive. This is funded by a quarter-cent sales tax and transfers from the General Fund. The quarter-cent sales tax that is used by this fund was reauthorized by voters for renewal in November 2019.

- Drainage Utility District: Restricted to use for storm water control development and educational programs, such as Earthfest. This fund is used for erosion control and creek maintenance projects, and revenues to this fund come from a fee on both residential water bills and business utility bills.

- Donations Fund: Used to account for any donations that the City receives. Revenues come from a variety of sources.

- Juvenile Case Manager/Truancy Prevention Fund: Restricted to use for necessary expenditures for the Juvenile Case Manager position and truancy prevention. Revenues to this fund come from a $5 fee from fine-only misdemeanors.

- Municipal Court Security Fund: Restricted to use for providing security services for the Municipal Court, including equipment for the marshals. Revenues to this fund come from a portion of the fee for a non-ordinance violation ticket.

- Coppell Recreation Development Corporation (CRDC) Fund: Used for improvements and maintenance to recreation facilities, including the Andrew Brown Park System, the trail system, and the Arts Center. This sales tax revenue fund was established to undertake projects for youth and adult amateur athletics, entertainment and public gathering facilities, exhibition and museum facilities, parks and recreational facilities, and more. Coppell voters reauthorized the CRDC’s use of sales tax revenue in the November 5, 2013, election.

- Capital Replacement Fund: Provides for the purchase of replacements for previously funded fleet items, including firetrucks, ambulances and police cruisers. This fund was established in FY 2014-2015 as a way to reduce spikes in the budget for the purchase of large-ticket items. As a result, whenever the City purchases a fleet piece, a portion of each payment is funneled into this fund over the course of its useful life. The funds are then used to make all fleet purchases.

- Rolling Oaks Memorial Cemetery: Restricted to use for the operation and maintenance of the City-owned cemetery. This fund will be used for repairs to the grounds and features and other maintenance projects. Revenues from this fund come from burial right and monument sales.

- Crime Control and Prevention District: Restricted to use for the support of police programs and services geared toward preventing crime. The Crime Control and Prevention District is used to fund School Resource Officers, community officers, and the City’s portion of the North Texas Emergency Communications Center (NTECC) and jail services. The Crime Control and Prevention District is funded by a quarter-cent sales tax that was reauthorized by Coppell voters in November 2011.

Learn more about Special Revenue Funds. Keep up to date with all things budget at coppelltx.gov/budget.

Original source can be found here.