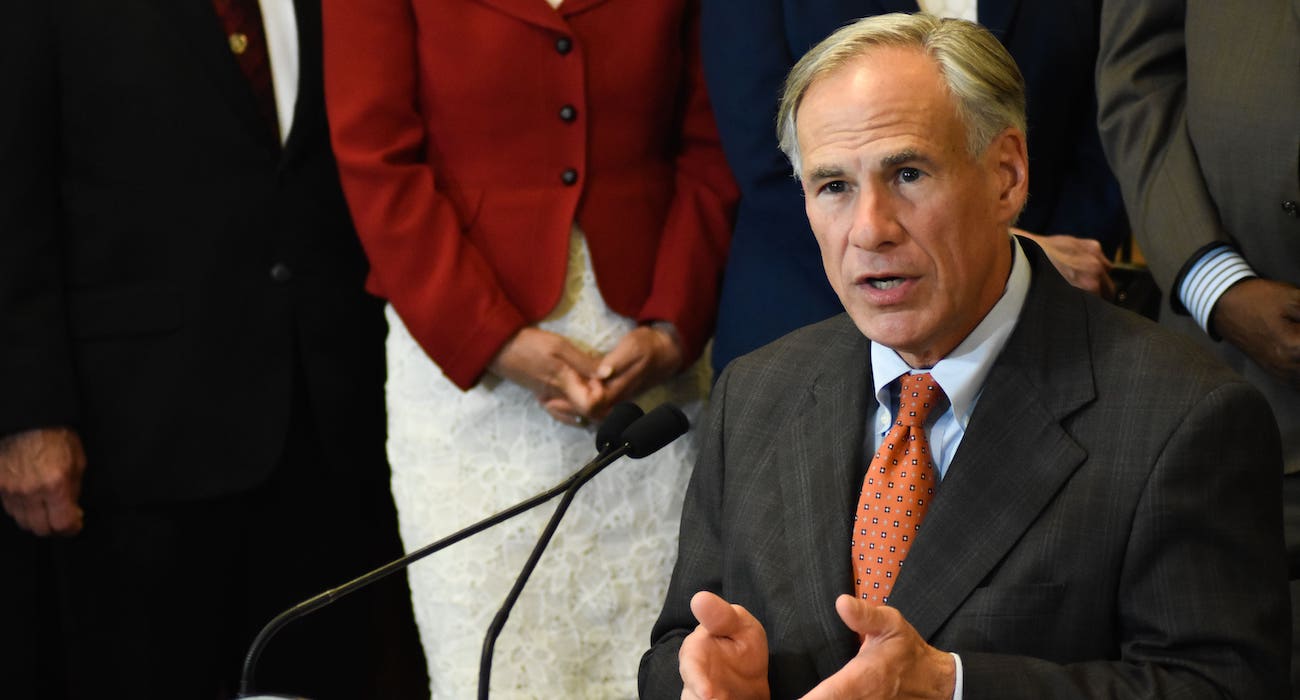

Texas Gov. Greg Abbott has continued beating the war drums in his fight for his property tax plan, vetoing another string of bills in an apparent attempt to force the Senate’s hand.

The governor vetoed three bills backed by Sen. Paul Bettencourt (R-Houston), a close ally of Lt. Gov. Dan Patrick, on June 15.

Both Bettencourt and Patrick have vocally advocated for a property tax cut plan that includes not only compression but also improved appraisal caps and homestead exemptions, as reported by The Dallas Express.

The Senate’s preferred plan differs from the proposal backed by Abbott and the Texas House, which consists entirely of compression.

The vetoed bills included SB 1998 (regarding ad valorem tax rate calculations), HB 2879 (relating to action venue for real property improvement contracts), and HB 2138 (allowing certain wildlife conservation nonprofits to sell charity raffles).

Bettencourt had either authored or sponsored all of the bills.

Abbott earlier vetoed SB 2035 (concerning the issuance of anticipation notes and obligation certificates), HB 4158 (relating to the tax limits on elderly and disabled persons’ homes), and SB 467 (increasing the criminal penalty for impairing a motor fuel pump).

Again, Bettencourt had either authored or sponsored each of the items.

When SB 467 was vetoed, Bettencourt called it an “[u]nneeded veto” of a bill that “would have cracked down on criminal gangs stealing motor vehicle fuel. Brought to me by the @dallas_da’s office, it would of [sic] increased the penalty for tampering with a retail motor fuel pump to a third-degree felony.”

In the accompanying veto proclamation, Abbott claimed the bill “would impose a harsher sentence for tampering with a gas pump than for damaging the electric grid or cutting a livestock fence. This bill can be reconsidered at a future special session only after property tax relief is passed.”

This language mirrored that included in other veto proclamations.

Lt. Gov. Dan Patrick criticized Abbott’s tactics, saying, “In a ploy to apparently get his way, Governor Abbott suggests he is threatening to destroy the work of the entire 88th Legislative Session — hundreds of thousands of hours by lawmakers doing the work the people sent us to do.”

“The Governor’s suggested threat today to veto a large number of Senate bills is an affront to the legislative process and the people of Texas,” he continued. “I will not abandon 5.7 million average Texas homeowners getting their $100,000 homestead exemption.”

Abbott spokeswoman Renae Eze said, “The Texas Senate must work with the Texas House to get a property tax bill to the Governor’s desk,” according to CBS. “The Governor has made clear the two chambers must reach agreement on property taxes.”

Regarding the tactic of killing Senate priority bills, Eze explained, “The Governor has used veto powers every legislative session as Governor, just like his predecessors. A veto is a tool provided by the Constitution to the Governor — in this case to ensure that property taxpayers in Texas will receive the most meaningful relief possible.”

The fight over property tax relief has spilled over into the special session that Gov. Abbott called immediately following the end of the 88th Regular Session. While the House quickly passed a compression-only plan and adjourned, the Senate has demanded negotiations for a more diverse plan.

Cait Wittman, a spokesperson for House Speaker Dade Phelan (R-Beaumont), struck out at the Senate, tweeting, “The Texas Senate is the only chamber that has not passed property tax reform in a way that is germane to @GovAbbott’s call. The House has passed the largest property tax cut in state history THREE TIMES this year.”

“The senate said no every time,” she claimed. “In the special session, the House came to work, passed its bills with bipartisan support, and adjourned – why is the Senate keeping Texans waiting?”

“They should follow the House’s lead so that Texans can have the property tax relief they deserve,” Wittman concluded.

However, the House is far from unanimous in its support for the compression-only plan.

Rep. Matt Schaefer (R-Tyler) tweeted his frustration, “For weeks the Tx House and Senate both yelled: ‘RAISE THE HOMESTEAD EXEMPTION!’ as a way to lower property taxes.”

“Now you gotta do what you said you would do. Doing nothing won’t fly back home. Debate the perfect plan all you want, but don’t yank homeowners around,” he wrote.

Other members, such as Rep. Dustin Burrows (R-Lubbock), disagreed with Schaefer’s analysis, but 16 Republican freshmen issued a letter urging for increased negotiation between the two chambers, stating, “[T]his is a critical issue that is worth taking the time to get right.”

The disagreement between the governor and lieutenant governor is one of the most public between the two leaders since their election to their respective offices in 2015.